By Neha Arvind

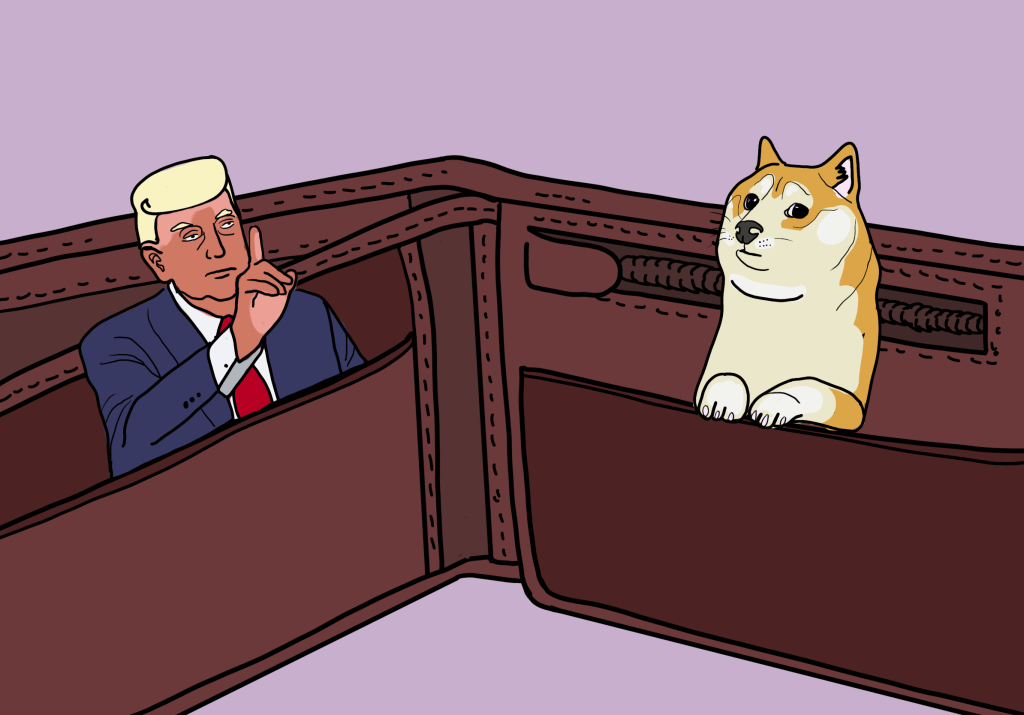

Illustration by Keo Morakod Ung

In the ever-evolving world of cryptocurrency, few things have sparked as much attention as the rise of memecoins. These digital assets, fuelled by internet humour and viral trends on social media, have drawn both fascination and suspicion from investors and crypto enthusiasts, due to their volatile nature and huge potential for growth. Memecoins have now entered the mainstream as US President Donald Trump launched his own memecoin, which has incited debate and controversy.

Memecoins are a crypto token, usually inspired by internet memes, slogans or trends which gain popularity through social media buzz and community-driven support, particularly on the platform X. While other cryptocurrencies, such as Bitcoin and Ethereum, have real-world use cases (like digital payments) and technical innovation backing them, memecoins don’t, meaning they lack any fundamental utility and their price is determined solely by demand for the token. Some memecoins have their own blockchain such as Dogecoin, however the majority of them are built as tokens on existing blockchain networks, usually on the Ethereum or Solana blockchains.

The highly volatile nature of memecoins presents immense opportunity for investors as, when tokens gain momentum on social media, price increases, causing FOMO (fear of missing out) from others on social media, driving the price up further. For example, Dogecoin, which is by far the largest and most successful memecoin, was launched in December 2013 at a price of $0.00029 per coin. It failed to gain traction for several years however, after being endorsed by Elon Musk in January of 2021, its price exploded and peaked at $0.68 in May of 2021 [1], a 234,000% increase from its original price. At its peak, Dogecoin was the 5th largest cryptocurrency with a market capitalization of $85 billion [2], paving the way for other memecoins. According to data from Finbold, there are over 1000 DOGE-made millionaires [3], showing that despite their unserious and playful nature, memecoins have the ability to deliver significant profits for investors.

However, while there are many success stories from memecoin investing, they are also extremely risky as they are speculative markets. Price rises can be followed by sharp declines as the buzz around the memecoin subsides, meaning late investors often lose money. For example, after Dogecoin peaked at $0.68, price fell by 75% within three months to $0.17.

The larger risk with memecoins however is the lack of regulation, this is because they are often unverified projects which cannot be bought on centralised exchanges, meaning that the majority of memecoins are not regulated and are therefore highly likely to be scams. Moreover, as they are a recent phenomenon, regulators are still struggling to classify memecoins under existing laws and with varying regulations from country to country, memecoins are in a legal grey area. Memecoins are often subject to ‘pump and dump’ schemes as well as ‘rugpulls’. A ‘pump and dump’ scheme is a type of market manipulation whereby the team behind the memecoin ,who are often large holders, as well as ‘whales’, who are investors with significant holdings, promote the project on social media, increasing interest and thus ‘pumping up’ the price. They benefit from investors’ FOMO, inflating the price, before ‘dumping’ their holdings by selling off their assets at these inflated prices, meaning large profits for ‘whales’ while smaller investors lose money as the price of the asset collapses. A ‘rugpull’ uses the same strategy, the creators build a community on social media and inflate prices before they ‘pull the rug’, withdrawing all funds from the project’s liquidity pool, leaving investors with a worthless asset which they are unable to exchange or sell as all liquidity is gone. For example, the memecoin $CUBA, launched in early January, quickly gained traction as the official X account of the Cuban Ministry of Foreign Affairs was used to promote the coin. The market cap soared to $30 million before being ‘rugpulled’, however it is unclear whether the Cuban government was directly involved in the scam or if their account was hacked. [4]

Although memecoins present large opportunities for profit for investors, as with any volatile asset, the opportunity for profit is just as significant as the risk for loss. The lack of regulation surrounding them, making them liable to market manipulation and ‘rugpulls’ exacerbate this risk for investors. Thus memecoins overall are a new way for creators and ‘whales’ to take advantage of investors’ FOMO and greed for their own profit while the vast majority of investors lose money.

The launch of the memecoin $TRUMP and $MELANIA has also foreshadowed potential political uses of memecoins. It is up for debate whether the $TRUMP coin was launched with political intentions or simply a money-making venture or perhaps both. On the one hand [5], it seems to be a way for Trump to add to his billions as 80% of the supply of the coin is owned by two companies: CIC Digital LLC and Fight Fight Fight LLC, both affiliated with the Trump Organization. As a result, according to estimates by Forbes, Trump has increased his net worth by $6.2 billion, doubling his net worth from before the coin was launched. On the other hand, however, some argue it was a political move, aiming to bolster support from the crypto community as well as undermining financial regulations and taunting federal ethics rules. It seems however, that the former is more likely, as Trump’s sons seem to be in control of the project, with Trump himself saying ‘I don’t know much about it’, implying the project was a vehicle for personal profit for the Trump family, rather than a political move. Furthermore, Trump has also received criticism from many in the crypto community as one crypto lobbyist told Politico the Trump coin was a ‘horrible look for the industry already trying to make a case that we’re not all hucksters, scammers and fraudsters’. [6]

Nevertheless, the future of memecoins and crypto seems unstable, as Gautam Chhugani, managing director of AB Bernstein, put it ‘ whichever way you see it, we think a new chaotic crypto era is here’.

[1] Dogecoin’s Price History (2013 – 2023, $) – GlobalData

[2] https://www.smh.com.au/technology/the-rise-and-rise-of-dogecoin-the-internets-hottest-cryptocurrency-20140124-31d24.html

[3] There are now over 1,000 DOGE-made millionaires after Dogecoin price skyrockets

[4] Cuban-linked Solana Memecoin Results in $30M Rug Pull

[5] https://www.aljazeera.com/news/2024/11/12/why-is-trumps-election-as-us-president-prompting-a-bitcoin-surge

[6] Here’s Everything Wrong With Trump’s Crypto Meme Coins