By Prachi Saraf

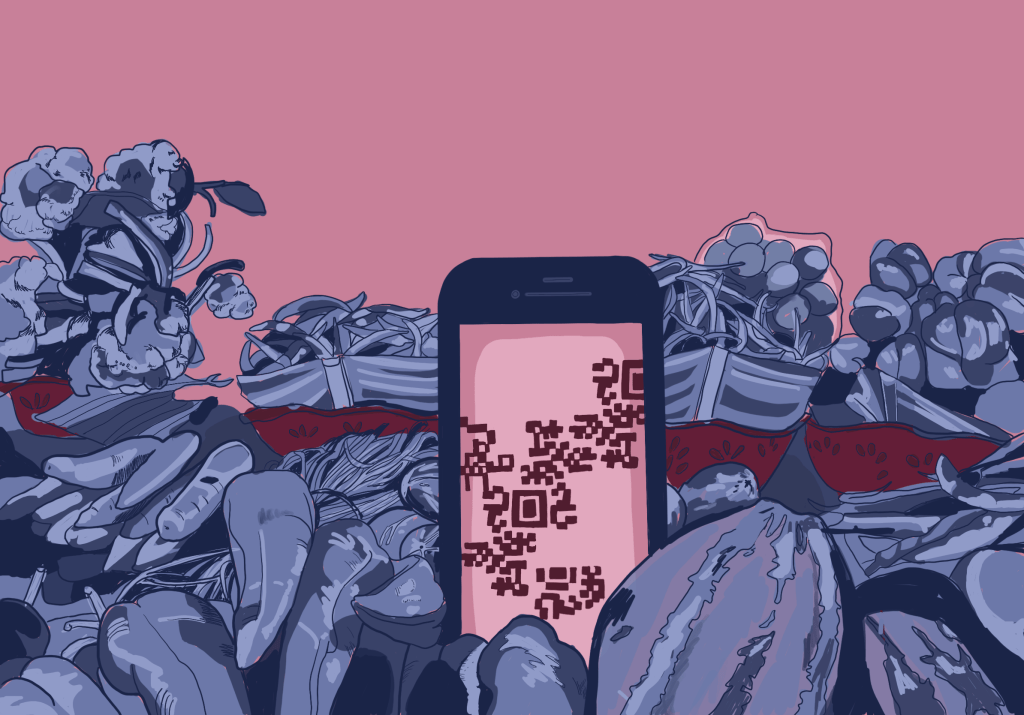

Illustration by Keo Morakod Ung

Digital India and the United Payments Interface (UPI)

India has been harnessing technology to transform its economy and foster interconnectedness. The rise in India’s IT service exports underscores its emergence as a global technology and innovation hub (EY, 2023). These sectors have contributed to economic growth and helped facilitate advancements in digitisation, particularly through revolutionary initiatives such as the development and rollout of Digital Public Infrastructure (DPI). Known as the ‘India Stack’, DPI is made up of three pillars: digital identification, payments and data management.

The ‘India Stack’ supports the objectives of the Government of India’s Digital India campaign, launched in 2015 with the aim of transforming India into a digitally empowered society and knowledge economy, with a focus on secure and stable digital infrastructure. The payments layer, particularly the United Payments Interface (UPI) system introduced in 2016 by the National Payments Corporation of India, has been especially impactful in boosting India’s financial inclusion and economic growth. This universal QR-code based digital payments system enables any consumer with a phone, active bank account and internet access to easily transfer money for free at any time. This banking technology infrastructure facilitates instant real-time payments via consumer-facing applications like PayTM and Google Pay. Its widespread use is evident, with scannable QR codes ubiquitous across shops and street vendors. Moreover, its simplicity, swiftness, 24/7 availability and lack of maintenance charges make it an appealing payment method for Indian citizens.

Features and Impacts

The UPI system employs reliable security measures, such as tokenisation to make payment data unreadable by replacing sensitive information with tokens. However, users must still be aware of potential fraud risks, including phishing calls, QR code scams, collect request fraud and remote screen monitoring. Whilst the system is secure, it is not immune to fraud and financial crime.

A unique feature of the UPI system is its interoperability, which allows multiple bank accounts within one app and seamless fund transfers across different banks, simplifying direct peer-to-peer (P2P) and peer-to-merchant (P2M) payments. This could position India as a powerful catalyst for cross-border payments, as adoption of UPI by other countries would render cross-border payments free of charge, thereby making international transfers cheaper for Indians both home and abroad. Currently, remittance fees are significantly high, with India being world’s largest remittance recipient since 2008 (Migration Data Portal). In 2020 alone, Indian consumers paid over 263 billion Indian Rupees in foreign exchange fees for currency conversion, payments and card purchases, emphasising the value of instant, interoperable UPI payments in reducing cross-border transaction costs.

This is just one of the many widespread impacts of the UPI system. Domestically, it has increased connectivity among India’s vast population, revolutionising engagement with digital payments. In 2022, India accounted for the highest number of global digital payments, with 46% of all real-time payments made in India (Business Standard, 2023), indicating its widespread adoption and effects.

More Impacts: Empowering the Rural Poor

The UPI has been particularly praised for enhancing financial inclusion, granting access to banking and financial services to those previously excluded. Having direct mobile access increases accessibility as it reduces dependency on cash and physical bank branches, which are often scarce in rural areas where over two-thirds of India’s population resides. However, despite smartphone usage and internet access increasing across the population, digital payments are still yet to be fully integrated into rural life. According to a survey in 2022 approximately 40% of rural inhabitants had no knowledge of UPI or digital payments (Times of India, 2022). Bridging this gap through improved internet connectivity and education to increase digital literacy is crucial for cultivating a financially educated and connected population.

Worldwide Reception

The UPI’s overall impact and success has gained international acclaim and interest. German Prime Minister, Volker Wissing, was impressed during his visit to India in August 2023, with the German Embassy expressing admiration for the digital infrastructure on social media.

Many countries, including the UK, have expressed interest in launching similar systems, with Nepal being the first to adopt its version of India’s UPI for its citizens. With seven countries having already adopted UPI, and France initiating a pilot project incorporating it within the Eiffel Tower in 2024, prospects for the system’s expansion are exciting. This recognition demonstrates not only its revolutionary impact, but also the opportunity to unlock India’s international economic reach and influence (ORF, 2024).

Looking Towards the Future

The future of UPI and digital infrastructure holds vast potential to impact India’s economic and political landscape. With innovations in technology, including aerospace with missions like Chandrayaan, and Bengaluru’s emergence as a major tech hub, India is cementing itself as a key global player. The trajectory is promising, paving the way for India’s evolution from an emerging economy to a prospective superpower.

Longer term, digital economy initiatives promise greater inclusion, moving towards achieving the aims of Digital India and a more equitable knowledge economy. This vision hinges on a focused policy direction, reduced corruption, and willingness by countries to embrace India’s technological advancements, ultimately supporting mutual prosperity in this globalised, interconnected world.

Sources:

https://www.ey.com/en_in/india-at-100/how-india-is-emerging-as-the-world-s-technology-and-services-hub

https://www.migrationdataportal.org/themes/remittances

https://www.business-standard.com/finance/news/india-tops-world-ranking-in-digital-payments-with-89-5-mn-transactions-123061000203_1.html

https://timesofindia.indiatimes.com/blogs/voices/unified-payments-interface-upi-usage-urban-upsurge-rural-slack/

https://www.orfonline.org/research/the-india-stack-as-a-potential-gateway-to-global-economic-integration#_edn29

Further reading:

https://www.ft.com/content/cf75a136-c6c7-49d0-8c1c-89e046b8a170